One secured way for eco-investors to support sustainable practices while still gaining income is with green bonds.

The Green Bond Principles (GBP), established by the International Capital Market Association (ICMA), serve as the cornerstone of this market, ensuring transparency, integrity, and the promotion of environmental projects.

Overview of Green Bond Principles (GBP)

The GBP, as set forth by ICMA, are voluntary guidelines that aim to support the growth of the green bond market by advising issuers on the core components of issuing a green bond. These principles have become a global standard, regulating the green bond market to enable capital-raising for projects with significant environmental benefits.

By adhering to the GBP, issuers can provide investors with transparent and credible green credentials, fostering a net-zero emissions economy and contributing to environmental protection.

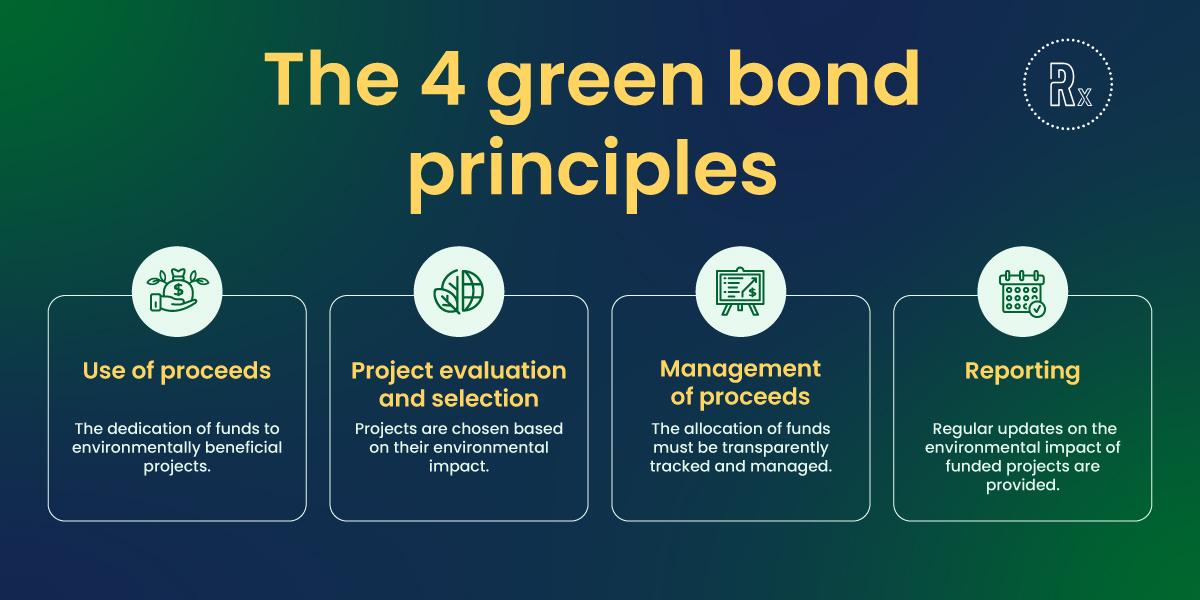

The GBP emphasizes the importance of transparency and disclosure throughout the issuance process, recommending a clear framework for issuers that covers 4 core principles: the use of proceeds, project evaluation and selection, management of proceeds, and reporting.

Principle 1: Use of Proceeds

The cornerstone of the Green Bond Principles (GBP) is the “Use of Proceeds,” which ensures that the capital raised through green bonds is dedicated to projects with substantial environmental benefits.

This principle focuses on investing in areas that benefit the environment. These areas include mitigating climate change, using renewable energy, preventing pollution, and conserving biodiversity.

Sustainable agriculture and environmental projects

The “Use of Proceeds” principle is particularly relevant in sectors like agriculture, where sustainability projects can have a significant impact:

- Sustainable water management: Initiatives that enhance water efficiency and quality in agricultural practices, such as advanced irrigation systems and water recycling programs, are vital for conserving this precious resource.

- Biodiversity conservation: Projects that support biodiversity, like agroforestry and organic farming, not only contribute to ecosystem health but also improve the resilience of agricultural systems.

- Soil health: Investing in soil restoration and conservation through sustainable practices like cover cropping and reduced tillage helps maintain soil fertility and reduces erosion.

- Renewable energy: Integrating renewable energy sources into agricultural operations, such as solar or wind-powered systems, reduces the carbon footprint and energy costs of farming activities.

Ensuring transparency and measuring impact

The GBP emphasizes the importance of transparency regarding the use of proceeds. Issuers are expected to provide detailed information on the funded environmental projects, including their expected environmental benefits. This level of disclosure ensures that investors are well-informed about the impact of their investments.

It’s crucial for entities financing such projects to measure and report on their environmental impact. This may include detailing improvements in water efficiency, biodiversity enhancements, better soil health, and reductions in GHG emissions. Such transparency not only aligns with the GBP but also reinforces investor confidence by demonstrating the tangible benefits of their investments.

Principle 2: Project Evaluation and Selection

The second principle of the Green Bond Principles (GBP) emphasizes the process for project evaluation and selection. This principle ensures that the projects financed by green bonds align with the defined environmental sustainability objectives.

This involves a transparent process where projects are assessed for their environmental benefits, ensuring they contribute to vital sustainability areas.

Criteria for project selection

The criteria ensure that only projects with significant environmental benefits are chosen for financing.

This involves setting clear environmental sustainability objectives and criteria and considerations of how projects contribute to focus areas like the reduction of carbon emissions, enhance energy efficiency, support sustainable water and waste management, or aid in biodiversity conservation.

Transparency in project evaluation

Transparency is key in the project evaluation process. Issuers are encouraged to disclose their project selection criteria, including the environmental objectives and the methodology used to assess the project’s alignment with these objectives.

This transparency allows investors to understand the basis on which projects were selected and how they contribute to environmental sustainability goals.

Example of application in regenerative agriculture

For instance, in the context of regenerative agriculture, the evaluation process might consider projects that employ innovative practices to improve soil health, reduce water usage, and increase biodiversity.

Projects can be evaluated on their ability to lower greenhouse gas emissions, restore ecosystems, or improve agricultural resilience to climate change.

Role of external reviews

To further ensure the integrity of the project evaluation process, issuers often seek external reviews from independent third parties. These reviews can provide an objective assessment of the projects’ alignment with the GBP and their expected environmental impact. External reviews add an additional layer of credibility and confidence for investors, ensuring that the projects financed are truly contributing to environmental sustainability.

In summary, Principle 2 of the GBP ensures that green bond proceeds are directed toward projects that are carefully evaluated and selected based on their environmental benefits.

Principle 3: Management of Proceeds

The third principle of the Green Bond Principles (GBP) focuses on the management of proceeds. This principle aims to ensure the transparency and integrity of how the funds raised from green bonds are allocated and used.

The principle mandates that the proceeds be exclusively applied to eligible green projects, with clear tracking and segregation mechanisms in place to prevent misuse and ensure accountability.

Segregation of funds

To uphold the integrity of the green bond, issuers are required to segregate or separate the proceeds from green bonds in a dedicated account or through other appropriate methods. This segregation ensures that the funds are exclusively used for the pre-identified eligible green projects, preventing any commingling with general corporate funds.

Tracking of proceeds

Issuers implement formal internal processes to track the allocation of proceeds to eligible projects. This tracking system is crucial for maintaining transparency and providing investors with the assurance that their investments are being used as intended. It involves documenting how each dollar is spent and ensuring that it aligns with the project’s environmental objectives outlined in the bond framework.

Link to green projects

The management of proceeds extends beyond mere allocation. It includes linking the funds to actual green projects, ensuring that the investment directly contributes to the project’s development and execution. This direct linkage is essential for establishing a clear connection between the green bond proceeds and tangible environmental benefits.

Transparency and reporting

Consistent with the GBP, issuers are encouraged to report on the allocation of proceeds, detailing how the funds are being used and the progress of funded projects. This reporting is typically done through annual updates, which may include qualitative performance indicators and, where feasible, quantitative measures of the environmental impact of the financed projects. Such transparency is key to building and maintaining investor trust and confidence in the green bond market.

The management of proceeds is a critical component of the GBP, ensuring that green bonds fulfill their purpose of financing projects that contribute to environmental sustainability. By adhering to this principle, issuers demonstrate their commitment to transparency, accountability, and the environmental integrity of their green bond offerings.

Principle 4: Reporting

The fourth and final principle of the Green Bond Principles (GBP) emphasizes the importance of reporting.

This principle is crucial as it ensures ongoing transparency and accountability regarding the environmental impact of the projects financed by green bonds. It requires issuers to regularly report on the use of proceeds and the environmental benefits of the funded projects, maintaining investor confidence and supporting the integrity of the green bond market.

Annual updates

Issuers are encouraged to provide annual updates on the allocation of proceeds until fully allocated, and on a timely basis thereafter if there are significant changes. These updates should include detailed information on the projects funded, the amounts allocated, and their expected or achieved environmental impacts.

Quantitative and qualitative performance indicators

Reporting should encompass both qualitative descriptions and, wherever feasible, quantitative performance indicators. This might include metrics such as the amount of renewable energy generated, greenhouse gas emissions reduced, or hectares of land conserved or restored. The aim is to provide a clear picture of the environmental benefits derived from the projects financed by the green bond.

Methodologies used

Issuers are also advised to disclose the methodologies used to assess the environmental impact of the funded projects. This transparency in methodology allows investors and stakeholders to understand how the reported outcomes were derived and ensures the credibility of the reported environmental benefits.

Accessibility of reports

To ensure accessibility, issuers should make the reports readily available to investors and other interested parties, often by publishing them on their public websites. This practice supports transparency and allows a broad audience to assess the environmental contributions of the green bond projects.

External reviews and third-party assurance

External reviews and third-party assurance play a crucial role in enhancing the credibility and integrity of green bonds.

The 4 types of external reviews and 3rd party assurance

External reviews are essential for assessing the environmental aspects of green bonds, providing an independent evaluation of whether the bond aligns with the Green Bond Principles (GBP). These reviews can take various forms, including:

- Second-Party Opinions (SPO): An independent assessment by an external party, often a specialized consultancy, that evaluates the bond’s environmental credentials and alignment with the GBP.

- Verification: A more detailed assessment, typically conducted by auditors or environmental consultants, which verifies the accuracy of the issuer’s claims regarding the environmental benefits of the financed projects.

- Certification: This involves evaluating the green bond against an established set of criteria or standards, such as the Climate Bonds Standard. Certification provides a formal recognition of the bond’s environmental attributes.

- Green bond ratings: Some agencies provide ratings specifically for green bonds, assessing their environmental impact and alignment with green principles.

Issue green bonds with transparent regenerative agriculture

Green bonds offer a pathway for investors to drive sustainable development, with a strong focus on selecting environmentally beneficial projects, managing funds with transparency, and reporting on tangible impacts.